Agriculture Insurance

In partnership with leading insurance companies, we offer agricultural insurance tailored specifically for smallholder farmers. This coverage safeguards farmers against climate-related risks, such as extreme weather events and poor yields. Through our USSD platform and mobile app, farmers can easily pay insurance premiums and receive payouts directly via mobile money, ensuring a seamless, hassle-free experience. By providing this crucial safety net, we help farmers mitigate risks, secure their livelihoods, and build resilience in the face of unpredictable challenges.

Weather Index Insurance

Through a partnership with the Agriculture Insurance Consortium (AIC) – M-Omulimisa provides highly subsidized agricultural insurance through our network of agents. AIC is a consortium of insurance companies providing subsidized (up to 50%) agriculture insurance under the Uganda Agricultural Insurance Scheme (UAIS) a Public-Private Partnership (PPP) arrangement with the Uganda Insurers Association (UIA) and the government of Uganda.

The service is commission-based and works through a network of agents. The more insurance policies the agents sell, the more money they make in earned commission. The commission helps agents meet their operational costs and provides an incentive for enhancing the service.

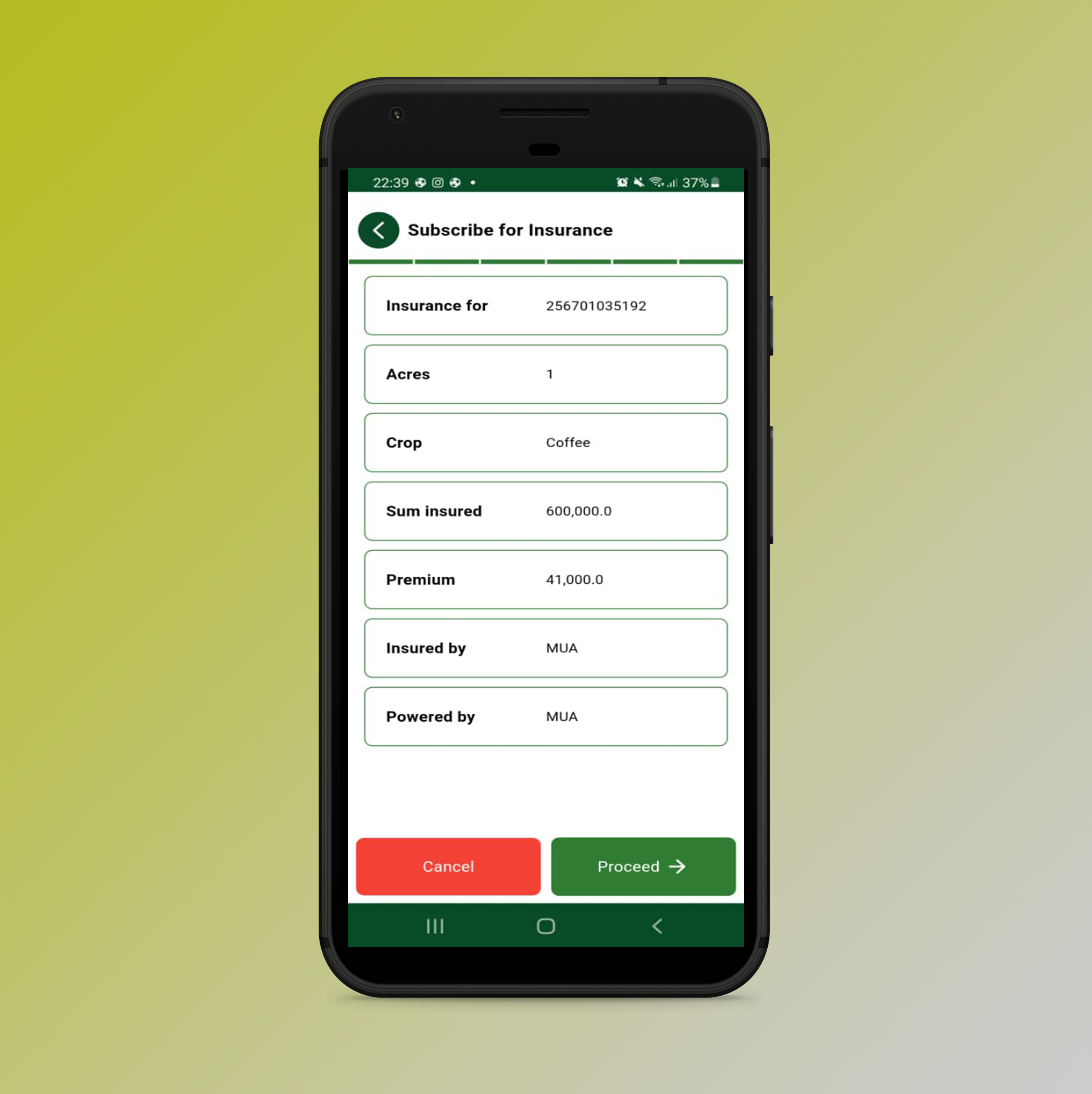

By making the service accessible via mobile phone, we make it easy for any farmer anywhere in Uganda to access insurance when they want it. The service is available through USSD – *217*101#, Mobile App (magrosure), and via our website. We integrate mobile money to make it easy for farmers to pay for agriculture insurance as well as receive compensation at the end of the season if they incur a loss due to weather-related hazards.

What is covered?

Drought and excessive rainfall

Commission

For each policy sold, the agent receives 4% of the basic premium as a commission. The commission is paid irrespective of whether the season is good or not. The commission is paid to the agent depending on the number of policies sold and can either be through mobile or a bank account for companies that are providing agriculture as a service to their clients.

Who can become an Agent?

- Individual

- Registered business

- Farmer Co-operative

- Community-Based Organization

- Farmer Organization

Calculation of insurance premium

- If a farmer has one acre of Maize and is expecting to get 15 bags (1,500 kgs) and the expected selling price after harvest is 800 per kg, the sum insured would be 1,500 kgs x 800 = 1,200,000

- The premium rate is 5% of the expected income or sum insured which is 0.05 x 1,200,000. The premium before the government subsidy would be 60,000

- The farmer pays 0.5% of the basic premium as a training levy that goes to the Insurance Regulatory Authority. 0.005 x 60,000 = 3,000

- Net premium paid by farmers is 50% of 60,000 + 3,000. This would come to 30,000 + 3,000 = 33,000.

- For Livestock, the sum insured as well compensation is based on the price of a mature animal. This applies as long as the animal is more than 3 months old.

- An agent receives 4% of the basic premium (before government subsidy) as commission. So, in this case, the agent receives 4% of 60,000 which is 2,400/=

Exclusions

Harvested Crops and Crops in transit; Any Crop which has been harvested prior to inspection by our loss assessor; A result of consequential loss whether or not caused by a defined peril. Where recognized good farming and harvesting practices have not been followed; Controllable diseases, weeds, and/or controllable insect infestations

Area Yield Index Insurance

What is covered?

The perils covered in this product are windstorms, frost, excessive rainfall, heatwave, hail, flood, drought, pests, and diseases.

How it works?

An Area Yield Index Insurance (AYII) is an insurance cover that insures farmers against a pre-set historical benchmark. The farmers are insured against a pre-set historical benchmark which is calibrated from historical yields and is known as the Average Production History (APH). APH is defined as a benchmark yield stated in the contract and is applied to determine if there are any pay-outs.

The APH is usually set per crop and Unit Area of Insurance (UAI). UAI is a geographical area comprising one or more unit(s) which can either be government boundaries such as provinces/ districts/ villages or Agroecological Zones (AEZs) derived from remote sensing/satellite data using machine learning technology. An AEZ is a geographical area that exhibits similar climatic conditions influenced by variables such as historical precipitation, temperature, soil moisture, and crop yields. In this note, AEZs were the chosen Unit Area of Insurance.

At the end of the season, trained enumerators measure yield levels for each AEZ via a method known as crop cutting experiments (see Appendix 2). This process involves measuring the harvest of sampled representative farmers. If the yields measured on the sampled farms are lower than the historical benchmark, then all the insured farmers in that area are paid.

The scale of the pay-outs is dependent on parameters such as the Trigger, Exit, and Total Sum Insured (TSI) at the exit. Whereby:

- Trigger is the threshold below which the farmers receive pay-out

- Exit is the threshold below which the farmers receive the maximum pay-outs

- TSI at exit is the maximum possible pay-out

Exclusions

Losses or damage arising directly or indirectly from any of the following are not covered:

- Fire and Lightning

- Explosions

- Theft

- Malicious damage

- Contamination, volcanic ashes fallout

- Non-emergency of crops

- Mould and gradual deterioration

- Controllable pest and diseases