Empowering Farmers through AI-Driven Credit Scoring

How It Works

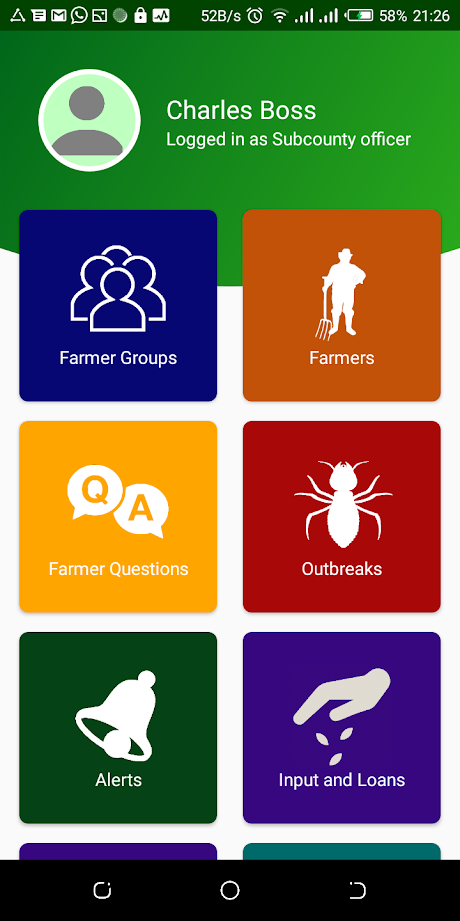

By analyzing diverse data points such as crop sales records, input purchase histories, and farm-level data, our AI system generates a reliable credit score for each farmer.

This credit score reflects the farmer’s business viability and financial behavior, providing a holistic view of their creditworthiness.

Farmers who might otherwise be excluded from formal financial systems now have a concrete and measurable profile that reflects their ability to manage loans responsibly.

Impact of AI-Powered Credit Scores

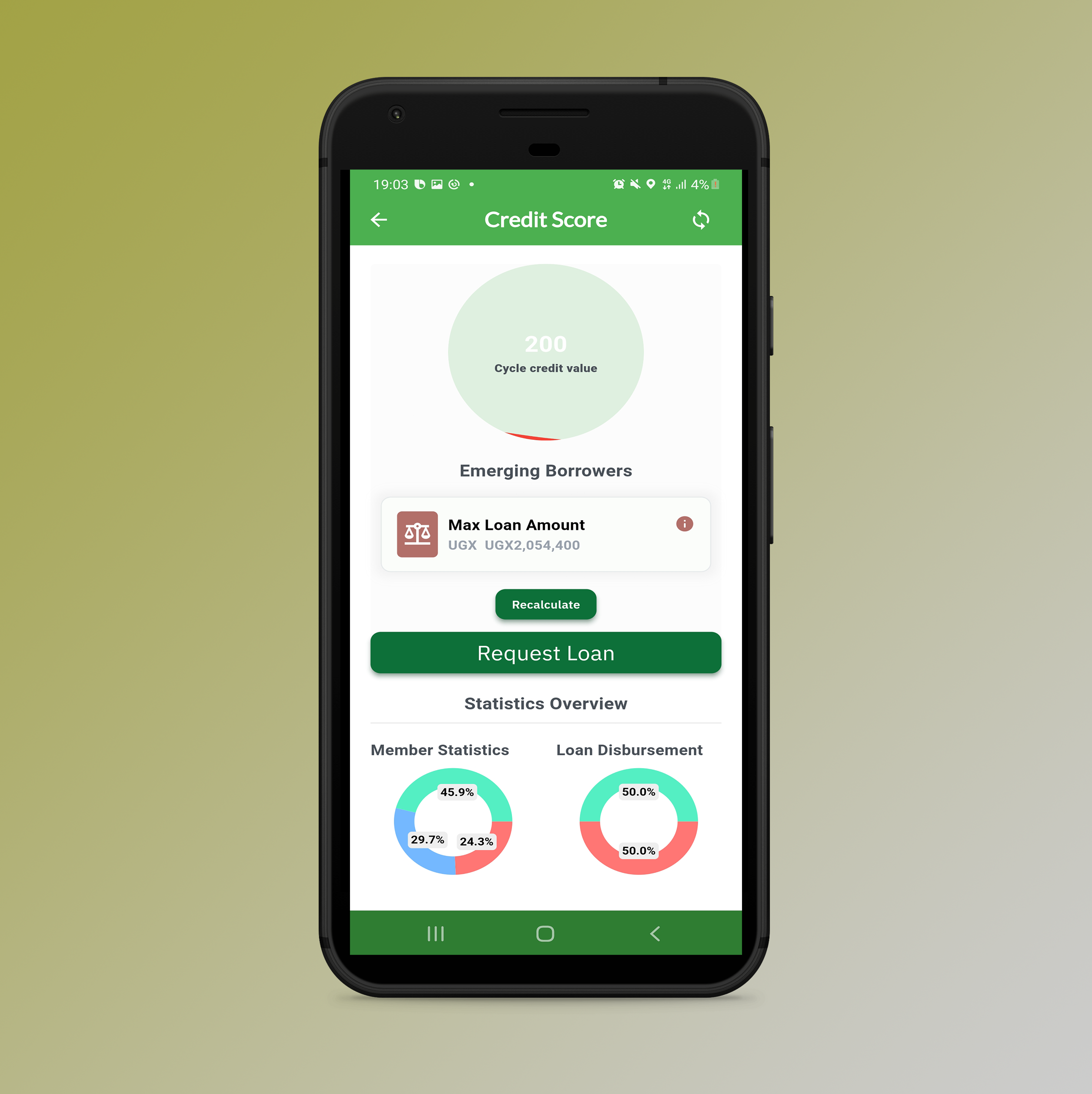

This AI-driven credit profile opens doors to affordable loans and credit lines for farmers, enabling them to purchase essential inputs such as seeds, fertilizers, and farming equipment.

These resources are critical for increasing productivity, improving crop quality, and meeting market demands. With affordable financing, farmers can move from subsistence farming to thriving businesses, scaling up operations to increase yields and profitability.

Driving Sustainable Growth in Rural Communities

The benefits of this innovative credit scoring solution extend beyond individual farmers to their communities.

By making credit more accessible, we’re supporting a ripple effect of growth: farmers invest more into their operations, cooperatives see improved yields, and local economies become stronger and more resilient.

Our solution fosters a cycle of sustainable growth, where farmers have the means to improve productivity, cooperatives benefit from higher-quality harvests, and communities thrive through increased economic activity.

A Step Toward Financial Inclusion

By transforming non-traditional data into actionable insights, our AI credit scoring solution plays a vital role in bridging the financial inclusion gap. Farmers now have access to reliable credit channels, empowering them to build a track record with financial institutions. This partnership-driven approach to credit scoring marks a significant step toward financial inclusion, creating new possibilities for farmers to achieve sustainable growth and long-term financial security.