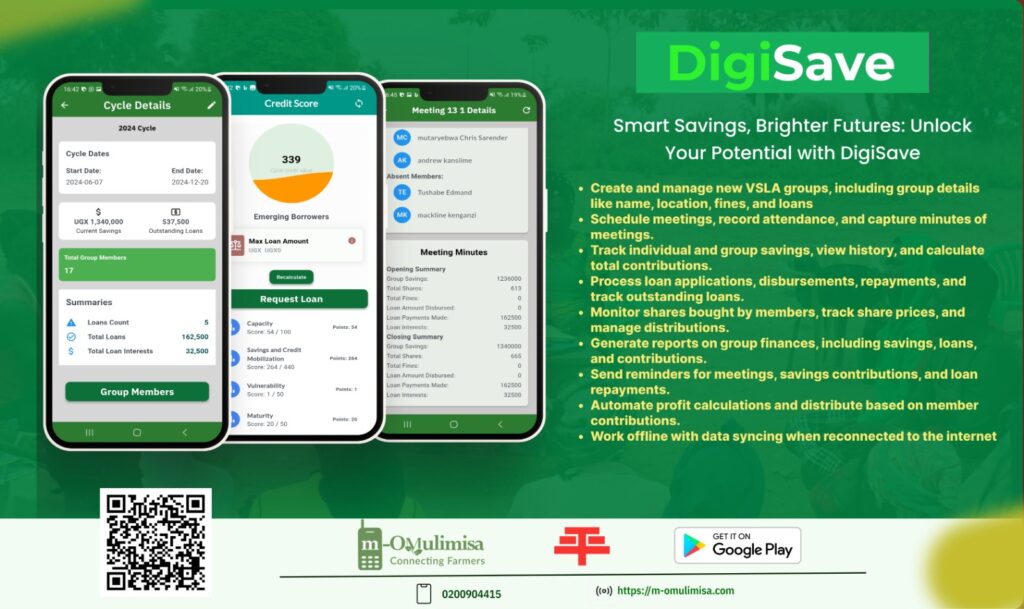

Vllage Savings and Loan Associations (VSLA) play a crucial role in empowering unbanked communities with financial services, but managing these groups can be challenging without the right tools. With AI-powered credit scoring and automated financial management tools, DigiSave is making it easier than ever for VSLAs to manage finances, process loans, track savings, and boost financial inclusion in rural communities. Here’s how DigiSave is transforming the financial landscape for VSLA groups.

𝟭. 𝗖𝗿𝗲𝗮𝘁𝗲 𝗮𝗻𝗱 𝗠𝗮𝗻𝗮𝗴𝗲 𝗩𝗦𝗟𝗔 𝗚𝗿𝗼𝘂𝗽𝘀

DigiSave makes it simple to set up and manage VSLA groups. With a user-friendly interface, group leaders can quickly create new groups, onboard members, and start keeping track of their finances. All group details are stored securely, ensuring smooth operations from day one.

𝟮. 𝗦𝗰𝗵𝗲𝗱𝘂𝗹𝗲 𝗠𝗲𝗲𝘁𝗶𝗻𝗴𝘀, 𝗥𝗲𝗰𝗼𝗿𝗱 𝗔𝘁𝘁𝗲𝗻𝗱𝗮𝗻𝗰𝗲, 𝗮𝗻𝗱 𝗖𝗮𝗽𝘁𝘂𝗿𝗲 𝗠𝗶𝗻𝘂𝘁𝗲𝘀

VSLA groups thrive on regular meetings, and DigiSave takes the hassle out of scheduling them. The platform allows group leaders to set up meeting schedules, send reminders to members, and track attendance digitally. It even includes a feature to capture and store the minutes of each meeting, ensuring transparency and accountability.

𝟯. 𝗧𝗿𝗮𝗰𝗸 𝗦𝗮𝘃𝗶𝗻𝗴𝘀 𝗮𝗻𝗱 𝗖𝗼𝗻𝘁𝗿𝗶𝗯𝘂𝘁𝗶𝗼𝗻𝘀

With DigiSave, members can track their individual and group savings effortlessly. The platform provides a clear view of savings history, including total contributions, ensuring members always know where they stand financially. This feature promotes transparency and trust within the group, as everyone has access to up-to-date financial data.

𝟰. 𝗣𝗿𝗼𝗰𝗲𝘀𝘀 𝗟𝗼𝗮𝗻 𝗔𝗽𝗽𝗹𝗶𝗰𝗮𝘁𝗶𝗼𝗻𝘀 𝗮𝗻𝗱 𝗧𝗿𝗮𝗰𝗸 𝗥𝗲𝗽𝗮𝘆𝗺𝗲𝗻𝘁𝘀

The loan process is one of the most critical services a VSLA offers, and DigiSave streamlines this process end-to-end. Members can apply for loans, and leaders can process disbursements, set repayment schedules, and monitor outstanding loans all within the platform. DigiSave ensures that repayments are tracked accurately, reducing the risk of mismanagement.

𝟱. 𝗠𝗼𝗻𝗶𝘁𝗼𝗿 𝗦𝗵𝗮𝗿𝗲𝘀 𝗮𝗻𝗱 𝗠𝗮𝗻𝗮𝗴𝗲 𝗗𝗶𝘀𝘁𝗿𝗶𝗯𝘂𝘁𝗶𝗼𝗻𝘀

Shares are a vital part of VSLAs, and DigiSave simplifies share management. Leaders can track shares bought by members, monitor share prices, and manage distributions when it’s time to share profits. This ensures that all members get their fair share based on their contributions.

𝟲. 𝗚𝗲𝗻𝗲𝗿𝗮𝘁𝗲 𝗗𝗲𝘁𝗮𝗶𝗹𝗲𝗱 𝗙𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗥𝗲𝗽𝗼𝗿𝘁𝘀

DigiSave provides comprehensive reporting features, allowing leaders to generate detailed financial reports on savings, loans, and contributions. These reports give members insights into the financial health of the group and help leaders make informed decisions on managing group finances.

𝟳. 𝗦𝗲𝗻𝗱 𝗔𝘂𝘁𝗼𝗺𝗮𝘁𝗲𝗱 𝗥𝗲𝗺𝗶𝗻𝗱𝗲𝗿𝘀

To keep things on track, DigiSave sends automated reminders to group members for upcoming meetings, savings contributions, and loan repayments. This reduces the chances of missed payments or unattended meetings, keeping the group organized and efficient.

𝟴. 𝗔𝘂𝘁𝗼𝗺𝗮𝘁𝗲 𝗣𝗿𝗼𝗳𝗶𝘁 𝗗𝗶𝘀𝘁𝗿𝗶𝗯𝘂𝘁𝗶𝗼𝗻

When it’s time to distribute profits, DigiSave makes the process seamless by automating profit calculations based on each member’s contributions. This ensures that all members receive their rightful share, making the process transparent and fair.

𝟵. 𝗔𝗰𝗰𝗲𝘀𝘀 𝗖𝗿𝗲𝗱𝗶𝘁 𝗦𝗰𝗼𝗿𝗶𝗻𝗴 𝗳𝗼𝗿 𝗢𝗻𝘄𝗮𝗿𝗱 𝗟𝗲𝗻𝗱𝗶𝗻𝗴

One of the standout features of DigiSave is its AI-powered credit scoring, which allows VSLA groups to assess their financial standing and access credit for onward lending. This opens up opportunities for members to get additional financing, further improving their economic prospects.

𝟭𝟬. 𝗢𝗳𝗳𝗹𝗶𝗻𝗲 𝗙𝘂𝗻𝗰𝘁𝗶𝗼𝗻𝗮𝗹𝗶𝘁𝘆 𝗮𝗻𝗱 𝗗𝗮𝘁𝗮 𝗦𝘆𝗻𝗰𝗶𝗻𝗴

DigiSave understands that internet access can be a challenge in rural areas. That’s why the platform offers full offline functionality, allowing groups to continue using the app even when not connected. Once reconnected, the app automatically syncs all data to ensure continuity and accuracy.

DigiSave is more than just a record-keeping tool—it’s a comprehensive platform that empowers VSLAs to manage their finances with ease, transparency, and security. By offering these robust features, DigiSave is helping to drive financial inclusion for rural communities across Uganda and beyond.

𝗚𝗲𝘁 𝗶𝗻 𝗧𝗼𝘂𝗰𝗵Are you interested in transforming the way your VSLA group manages its finances? We’d love to hear from you! Contact us today at 𝗶𝗻𝗳𝗼@𝗺-𝗼𝗺𝘂𝗹𝗶𝗺𝗶𝘀𝗮.𝗰𝗼𝗺 or call +𝟮𝟱𝟲𝟳𝟬𝟭𝟬𝟯𝟱𝟭𝟵𝟮 to learn more about DigiSave and how it can benefit you.

#VSLA #FinancialInclusion #AI #MachineLearning #AgTech #DigiSave #Uganda #DigitalTransformation